The cost of living is on the rise, with one particular area seeing an even sharper increase – car insurance premiums. This article delve the information about car insurance premiums are going full throttle.

Fluctuating Car Insurance Rates

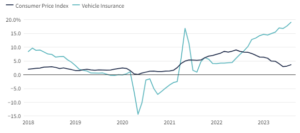

Car insurance premiums have surged by a remarkable 19.1% over the past year. This is the largest spike in premiums since 1976 and significantly outpaces the overall inflation rate of 3.7%. Insurers attribute this substantial increase to the growing expenses associated with repairing and replacing vehicles, which they are passing on to consumers.

Challenges Faced by Insurers

While the prices of new cars have stabilized, indicating that future rate hikes may be more moderate, the recent spike in car insurance costs is a cause for concern. In August, travel-related expenses contributed to the overall inflation surge, with notable increases in gas prices (up 10.6% from July), airline ticket costs (up 4.9%), and new car prices (up 0.3%).

However, these numbers pale in comparison to the staggering 2.4% jump in vehicle insurance premiums for the same month, resulting in a 19.1% increase over the past year. This makes it the fastest increase since 1976, as illustrated in the chart below, highlighting the alarming rate at which car insurance costs are climbing in comparison to the general inflation rate.

Potential Relief on the Horizon

Car insurance rates saw a significant drop in April 2020 as pandemic-related restrictions kept people off the roads. However, since then, they have made a strong resurgence. Insurers cite increasing expenses for vehicle repairs and replacements due to surging prices for both new and used vehicles as the reason for passing these costs on to policyholders. As an example, State Farm reported underwriting losses of $13.4 billion in its auto insurance business in 2022.

Expert Strategies to Reduce Premiums

There is potential relief on the horizon, though. The relentless surge in new car prices seen last year has subsided. In August, new car prices were only 2.9% higher over 12 months, down from a 13.2% yearly increase in June 2022. This change could eventually alleviate some of the upward pressure on insurance rates. According to Ian Shepherdson, chief economist at Pantheon Macroeconomics, there is typically a lag of about a year between vehicle insurance inflation and new car prices. Therefore, the sustained slowdown in new car price increases suggests that insurance prices are likely to slow down as well, even though this shift hasn’t happened yet. In the meantime, individual consumers have several strategies to consider for reducing their premiums, as advised by experts. These strategies include shopping around for better insurance rates, increasing deductibles, and taking a defensive driving course.